The Japanese stock index Nikkei fell by 50,000 points, the first drop in its history, according to Bloomberg. This happened in a panic, causing a sharp drop in the series of record highs for the Japanese stock market. Experts note that positive forecasts, linked with the expansion of government spending and new stimulating policies, combined with rising government bond yields and new political stimuli, have supported the recovery of the financial market.

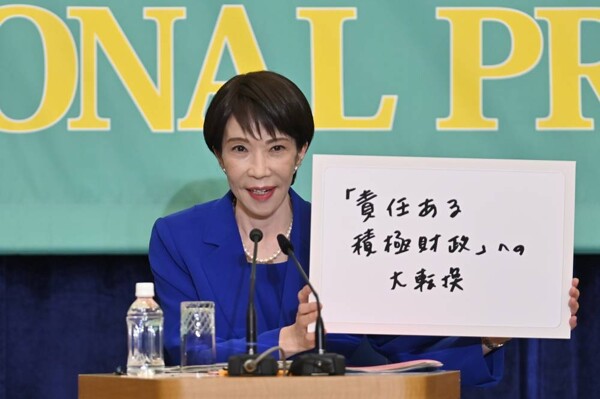

"Expectations of a change in the economic policy, especially in the sphere of economics, created a favorable atmosphere for investors. This affects not only in the Nikkei, but also in the dynamics of financial markets," — says an analyst of the financial sector.

The drop of 50,000 points symbolized the collapse of the Japanese economic policy after the long period of monetary policy of low interest rates and inflationary targets. The new platform of the financial regulator promotes the activation of financiers in key areas, which increases the confidence of investors in the prospects.

Earlier, the Nikkei index fixed significant falls in the middle of the 1980s, but then this rate was not outstanding. At the current economic conditions, analysts note that the next decade may be a long-term trend.